Cryptocurrencies have become a popular investment asset, and Bitcoin and Ethereum are among the most well-known and valuable digital currencies. As a result, trading platforms and exchanges that allow users to buy, sell, and trade these cryptocurrencies have emerged. One of the most commonly traded pairs is BTC USDT, which represents the exchange rate between Bitcoin and Tether, a stablecoin that is pegged to the value of the US dollar. In this article, we will explore everything you need to know about trading BTC USDT platform and much more.

Crypto Exchange and BTCUSDT Trading

A crypto exchange is an online platform that allows users to buy and sell cryptocurrencies, including Bitcoin and Ethereum. When trading on a crypto exchange, you can either buy or sell BTCUSDT at the current market price, or you can set a limit order to buy or sell BTCUSDT at a specific price. The trading fee varies from exchange to exchange, and it is usually a small percentage of the trading volume. To trade BTCUSDT on a crypto exchange, you will need to create an account and verify your identity.

Leverage Trading Crypto and BTC USDT

Leverage trading is a trading strategy that allows you to borrow funds to increase your trading position. In the case of BTC USDT trading, leverage trading means that you can use borrowed funds to increase the size of your Bitcoin or Tether position. The leverage ratio varies from exchange to exchange. However, leverage trading is a high-risk strategy that can result in significant losses if the market moves against your position.

Bitcoin Trading Platform and BTC/USDT

A Bitcoin trading platform is a specialized exchange that focuses on Bitcoin trading. These platforms offer a wide range of trading tools, including charts, technical indicators, and order types. They also allow users to trade Bitcoin with other cryptocurrencies or fiat currencies. Some of the most popular Bitcoin trading platforms that offer BTC/USDT trading include Binance, BitMEX, and Bitfinex.

BTC Exchange and BTCUSDT Trading

A BTC exchange/Bitcoin exchange is a crypto exchange that specializes in Bitcoin trading. These exchanges offer a wide range of trading tools and services, including spot trading, margin trading, and futures trading. Some of the most popular BTC exchanges that offer BTCUSDT trading include Binance, Huobi, and OKEx.

Interesting Information about Mehndi design

Leverage Futures and BTC/USDT

Leverage futures trading is a trading strategy that allows you to use leverage to trade Bitcoin futures contracts. Bitcoin futures trading contracts are agreements to buy or sell Bitcoin at a predetermined price and date in the future. Leverage futures trading allows you to increase your position size without having to put up the full value of the contract. The leverage ratio varies from exchange to exchange. Some of the most popular BTC futures trading platforms that offer BTCUSDT futures trading include BitMEX, OKEx, and Deribit.

Ethereum Trading and Ethereum Margin Trading

Ethereum is another popular cryptocurrency that is often traded on crypto exchanges. Ethereum trading is similar to Bitcoin trading, and you can buy and sell Ethereum on most crypto exchanges that offer BTC trading. Ethereum margin trading is a trading strategy that allows you to borrow funds to increase your Ethereum position. The process is similar to Bitcoin margin trading, and it is a high-risk strategy that can result in significant losses.

Ethereum Futures Trading and ETH Futures Trading

ETH futures trading is the process of trading futures contracts related to the price of Ethereum. These contracts allow traders to speculate on the future price of Ethereum and can be traded on many cryptocurrency exchanges.

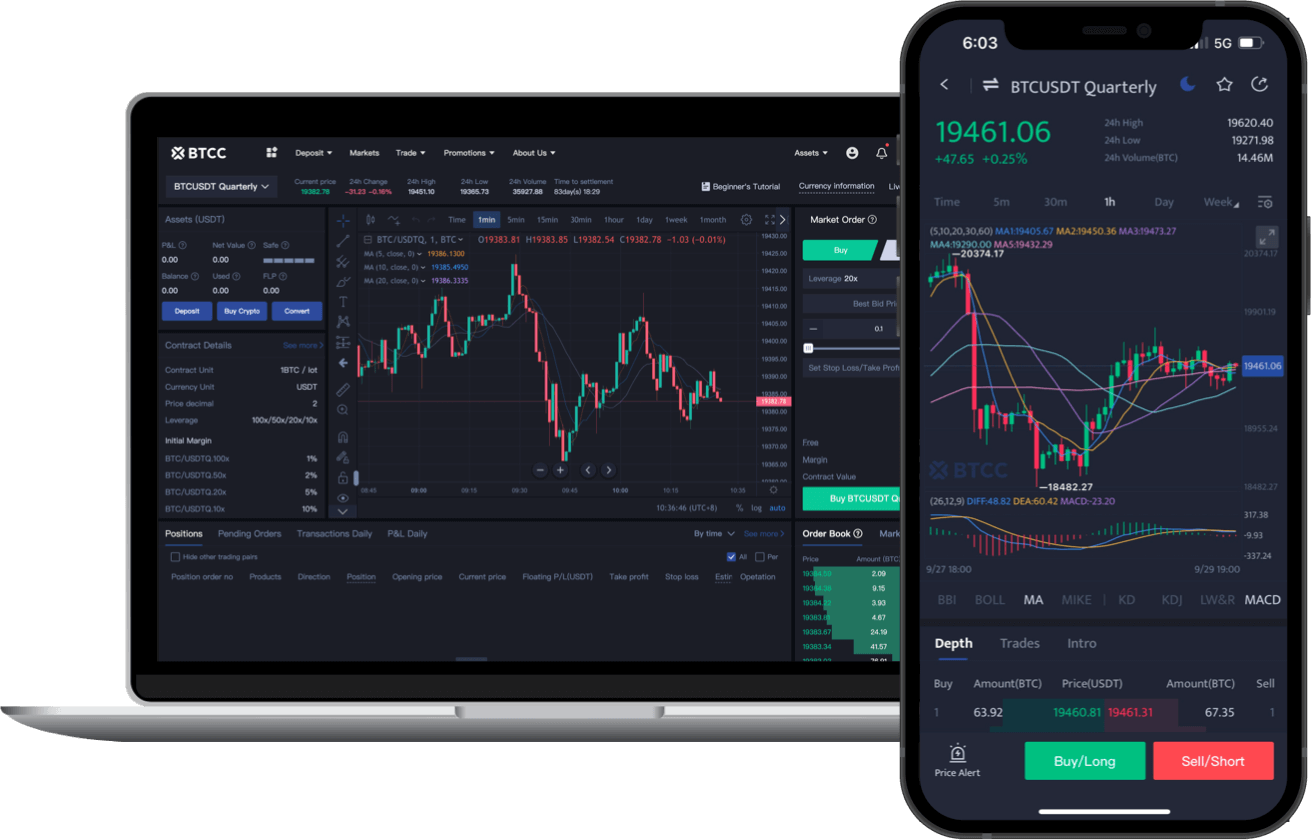

BTCC

BTCC is a popular crypto exchange that offers a range of trading products, including spot trading, margin trading, and futures trading. It is one of the oldest and most well-known crypto exchanges, having been founded in 2011.

Conclusion

BTC USDT is a popular trading pair that allows users to trade Bitcoin exchange with Tether. Crypto exchanges offer a range of trading products, including leverage trading, margin trading, and futures trading, that can amplify potential profits but also increase the risk of losses. Traders should always do their research and carefully consider their risk tolerance before engaging in leverage trading or other high-risk trading strategies.